Frequently Asked Questions

For answers to frequently asked questions, the Trustees of the Opioid Master Disbursement Trust II have prepared the following FAQs, which will be updated from time to time with additions and changes based on relevant circumstances and information. Capitalized terms used but not defined in these FAQs have the definitions given to them in the 2022 Plan or 2023 Plan, as applicable. Both Plans and other important documents are available here.

1. What is the Opioid Master Disbursement Trust II?

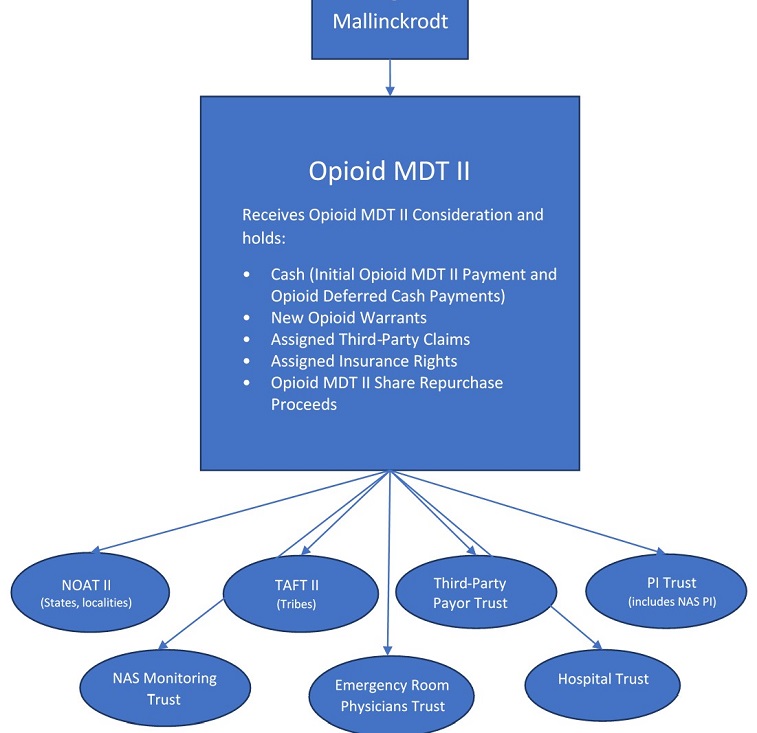

The Opioid Master Disbursement Trust II (the “MDT II”) was created out the first bankruptcy cases of Mallinckrodt PLC and certain of its subsidiaries (“Mallinckrodt”) (In re Mallinckrodt PLC, Case No. 20‐12522 (JTD) (Bankr. D. Del.)). The MDT II is the “hub” trust in a “hub & spoke” trust design, as shown in the below graphic,[1] created to provide distributions (from funds paid by Mallinckrodt and other consideration received pursuant to the Mallinckrodt 2022 Plan) to the public and private creditor trusts (“spoke” trusts) and to holders of allowed Class 9(h) Other Opioid Claims.

Pursuant to the 2022 Plan, the MDT II’s primary responsibilities are to: (i) receive the upfront and deferred opioid settlement funds (the “Initial Opioid MDT II Payment” and “Opioid Deferred Cash Payments”, respectively) (an obligation amended pursuant to the 2023 RSA and 2023 Plan); (ii) monetize the New Opioid Warrants (which MDT II did in December 2022); (iii) investigate and pursue claims against third‐parties that are assigned to the MDT II (pursuits that are still on-going); (iv) fix a bar date and administer “Other Opioid Claims” that were not resolved as part of the 2022 Plan (a process that is still on-going); and (v) make distributions to the public and private creditor trusts who are to further disburse funds to creditors who must use the settlement proceeds for approved abatement strategies, or in the case of the personal injury trust, to compensate individuals for damages because of opioid-related bodily injuries. MDT II shall make distributions to its beneficiary trusts in accordance with the 2022 Plan and MDT II Trust Agreement, without any further discretion from the MDT II Trustees.

With respect to (i) above: pursuant to the Final Amendment to the Opioid Deferred Cash Payments Agreement (signed in August, 2023, as part of the 2023 RSA), Mallinckrodt fulfilled its remaining payment obligations to MDT II by way of a final, $250 million payment that was received by MDT II on August 24, 2023, and then disbursed to the Public and Private Opioid Creditor Trusts, per the waterfall under the 2022 Plan, on August 29, 2023. MDT II will receive no further Opioid Deferred Cash Payments from Mallinckrodt.

2. Who are the beneficiaries of the Opioid Master Disbursement Trust II?

The beneficiaries of MDT II include: (i) the National Opioid Abatement Trust II (a trust established for the benefit of States, territories and municipalities); (ii) the Tribal Abatement Fund Trust II (a trust established for the benefit of federally recognized American Indian Tribes); (iii) the Third‐Party Payor Trust (a trust established for the benefit of, among others, health insurers); (iv) the PI Trust (a trust established for the benefit of personal injury victims including those who suffer from neonatal abstinence syndrome); (v) the Hospital Trust (a trust established for the benefit of, among others, healthcare providers); (vi) the NAS Monitoring Trust (a trust established for the purposes of monitoring and treating the epidemiological effects of neonatal abstinence syndrome); (vii) the Emergency Room Physicians Trust (a trust established for the purposes of providing distributions to qualifying health care providers); (viii) the Public Schools’ Special Education Initiative Trust (a trust established to provide grants to provide abatement through public schools); (ix) the Truth Initiative Foundation (whose mission includes youth and young adult education and prevention) via the Ratepayer Account; (x) the FHCA Opioid Claimants (that is, (a) the United States Department of Health and Human Services, and its component agencies, the Centers for Medicare and Medicaid Services and Indian Health Service, (b) United States Department of Veterans Affairs, Veterans Health and (c) United States Department of Defense, Defense Health Agency); and (xi) holders of Allowed Class 9(h) Other Opioid Claims.

3. Who are the Trustees?

The Bankruptcy Court approved the appointment of: (i) Jenni Peacock; (ii) Michael Atkinson, and; (iii) Anne Ferazzi as Trustees of MDT II. Jenni Peacock serves as Managing Trustee. You can locate the Trustees’ biographies here. The MDT II Trustees are responsible for stewarding the MDT II, including by receiving cash and non-cash assets from Mallinckrodt, pursuing assigned causes of action (for the benefit of the MDT II beneficiaries), and making distributions to MDT II beneficiaries in accordance with the 2022 Plan and other governing documents.

4. What are the assets held by the Opioid Master Disbursement Trust II?

On the Effective Date of the 2022 Plan, MDT II was funded with both cash and non‐cash assets, including an initial payment of $450 million received on the Effective Date. Under the 2022 Plan, the MDT II was to receive approximately $1.725 billion from Mallinckrodt over eight (8) years, subject to Mallinckrodt’s right to prepay (at a discount) all or some of those amounts within eighteen (18) months of the Effective Date.The 2023 RSA and 2023 Plan amended this obligation, such that MDT II received its final payment of $250 million in August 2023. Together, the initial payment and final payment totaled $700 million.

Pursuant to the 2022 Plan a wholly‐owned subsidiary of MDT II received warrants for 19.99% of Mallinckrodt’s common stock (subject to dilution from the Management Incentive Plan). The warrants had a strike price tied to Mallinckrodt’s equity capitalization provided under the 2022 Plan. On the Effective Date, MDT II transferred its ownership interest in the subsidiary to the National Opioid Abatement Trust II, the Tribal Abatement Fund Trust II, the PI Trust, and the Hospital Trust. On December 8, 2022, the Trustees reached an agreement with Mallinckrodt to cancel the warrants in exchange for a $4 million payment to the MDT II subsidiary. The proceeds from this transaction were distributed to certain opioid creditor trusts pursuant to the 2022 Plan on August 29, 2023. Pursuant to the 2023 Plan, MDT II received contingent value rights (“CVR”), essentially warrants, in the company (which will provide some value if the performance of the company dramatically improves).

MDT II also received, pursuant to the 2022 Plan, non‐cash settlement consideration in the form of an assignment of certain of the Mallinckrodt’s claims and causes of action held against third parties. These claims include (i) any and all claims Mallinckrodt, or certain of its affiliates, would be entitled to under its insurance policies providing coverage for opioid claims; (ii) claims against Medtronic plc and/or its subsidiaries; (iii) any opioid related claims not Released under the 2022 Plan against third parties; and (iv) the right to receive proceeds of Share Repurchase Claims against certain current or former Mallinckrodt plc shareholders. The MDT II is charged with monetizing, to the extent possible, these non‐cash assets for the benefit of certain of the MDT II’s beneficiaries. Any recoveries and the timing of collection of proceeds from such non‐cash assets are uncertain at this time.

5. When can the Creditor Trusts expect distributions from the Opioid Master Disbursement Trust II?

The final payment on account of the Opioid Deferred Cash Payments made by Mallinckrodt was received by MDT II on August 24, 2023, and distributed on August 29, 2023, to the Public and Private Opioid Creditor Trusts, per the waterfall under the 2022 Plan. Distributions from the Public and Private Opioid Creditor Trusts to their respective beneficiaries are made in accordance with the 2022 Plan and the governing documents of those trusts; distributions are executed by the Trustees of those trusts.

The timing for any future distributions is currently unknown, as such distributions depend upon the continued progression of the litigations and the value of the CVRs.

6. What is a Class 9(h) Other Opioid Claim?

Claims that are not a Governmental Opioid Claim, Third‐Party Payor Opioid Claim, Hospital Opioid Claim, Ratepayer Opioid Claim, NAS Monitoring Opioid Claim, Emergency Room Physicians Opioid Claim, a Public School Opioid Claim, or PI/NAS Opioid Claim, but including, for the avoidance of doubt, Co‐Defendant Claims (other than Co‐Defendant Claims held by Released Co‐Defendants) and any No Recovery Opioid Claims that are Allowed after the Effective Date under section 502(j) of the Bankruptcy Code.

7. What are the procedures for submitting a Class 9(h) Other Opioid Claim?

The Other Opioid Claims Bar Date occurred on November 18, 2022. The MDT II Trustees continue to analyze and address the Other Opioid Claims that were filed.

8. What are the Opioid Master Disbursement Trust II’s disclosure obligations?

Every four (4) months, the MDT II is required to provide each of the Opioid Creditor Trusts and the Future Claimants’ Representative reporting on: any litigation proceedings, assets (including the value thereof), expenditures, distributions and forward‐looking projections. Each report shall be filed on the docket of the bankruptcy cases and posted to this website. Additionally, the Trustees will hold at least one (1) call every four (4) months for the Opioid Creditor Trustees to answer the questions of Opioid Creditor Trustees relating to the MDT II.

9. How was the Opioid Settlement implemented?

On October 12, 2020, Mallinckrodt plc and certain of its affiliates, a pharmaceutical company engaged in the development, manufacturing, and marketing of pharmaceutical products, including opioids, commenced chapter 11 proceedings in the District of Delaware to, among other things, address its opioid liabilities. Immediately prior to the October 12, 2020 petition, Mallinckrodt entered into a Restructuring Support Agreement (“2022 RSA”) with (i) Attorneys General for 50 States and Territories (including the District of Columbia), (ii) the Plaintiffs’ Executive Committee (“PEC”) in the multidistrict opioid litigation pending in Ohio (MDL No. 2804) (representing the interests of, among others, thousands of cities, counties, other local governments and American Indian Tribes), and (iii) an ad hoc group of unsecured bondholders holding more than 84% of Mallinckrodt’s subsidiary-guaranteed unsecured bond debt. The 2022 RSA was later joined by, among others, the multi-state governmental entities group (“MSGE Group”), representing more than 1,300 local governmental opioid claimants.

During the first bankruptcy, these public creditor ad hoc committees worked with the Opioid Claimants Committee to amend the 2022 RSA and its related documents, which contemplate, among other things, a global opioid settlement that would channel all opioid claims against Mallinckrodt and certain other non-debtor parties to a series of trusts, funded by certain cash and non-cash consideration, for the benefit of Mallinckrodt’s public and private opioid creditors (the “Opioid Settlement”). To implement the Opioid Settlement, the MDT II was created to disburse funds to the public and private creditor trusts. These beneficiaries of the Opioid Settlement must use the disbursed funds for opioid abatement or in the case of individuals, for personal injury damages sustained as a result of the use of Mallinckrodt’s opioid products. The Opioid Settlement is incorporated into the 2022 Plan, which was confirmed by Order dated March 2, 2022, and became effective on June 16, 2022.

10. How do I get more information about the Opioid Creditor Trusts?

If you are a beneficiary of one of the “spoke” Opioid Creditor Trusts you may learn more by contacting the teams established for each of the Opioid Creditor Trusts. Websites have been established for the following Opioid Creditor Trusts:

- NOAT II: https://www.nationalopioidabatementtrust.com/

- TAFT II: https://www.tribalopioidsettlements.com/MallinckrodtBankruptcy

- Personal Injury Trust: http://www.mnkpitrust.com/

- Hospital Trust: https://mlnkhospitalsettlement.com/

- Third-Party Payor Trust: https://restructuring.ra.kroll.com/MallinckrodtTPPTrust/

- Independent Emergency Room Physicians Trust: https://www.ierptrust.com/

- NAS Monitoring Trust: https://nasmonitoringtrust.com/

MDT II cannot answer questions regarding any individual claim and will instead forward any inquiries received to the appropriate trust listed above. Claimants are encouraged to contact the appropriate trust directly with questions (for example, questions regarding personal injury claims should be directed to the Personal Injury Trust).

These FAQs will be updated with additional information when it becomes available.